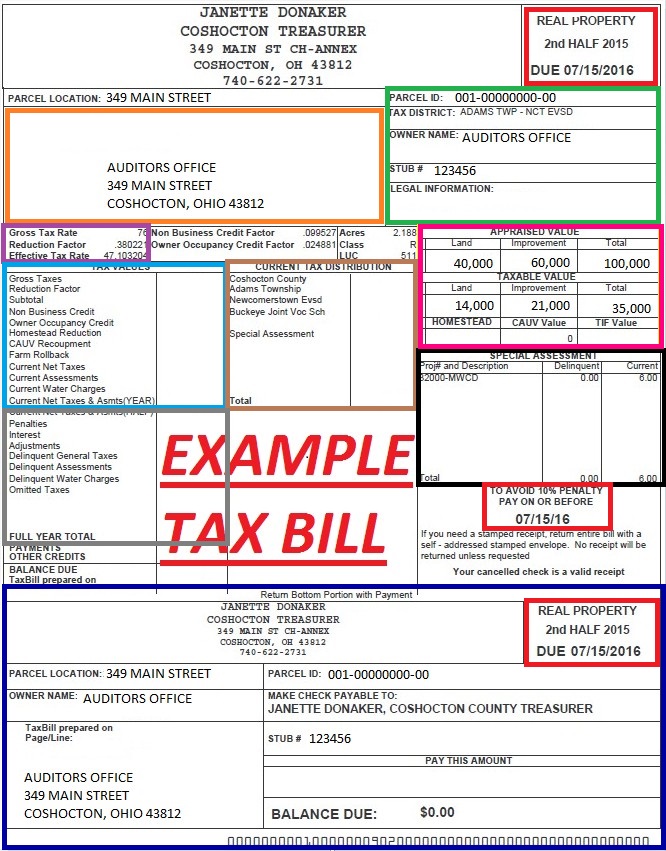

DUE DATE – This is where you will find the due date for first/second half taxes to avoid a late fee. You can find this information in the upper right corner of your bill as well as at the bottom of the page.

TAX MAILING INFORMATION – This is the information listed on the current tax rolls as the ownership and tax mailing information for the property. Please review this information carefully. If you need your tax mailing address changed contact the Treasurer’s Office at 740-622-2731.

PARCEL & OWNER IDENTIFICATION – You are able to find different specific pieces of identification for your property such as the Parcel ID, which is the unique identifier for each parcel, the Tax District that determines your gross tax rate and the distribution, as well as legal identification such as the subdivision your property is in. Please have your Parcel ID available when contacting our office.

GROSS & EFFECTIVE TAX RATES – The Gross Tax Rate is the voted millage when the tax levies were originally passed. With the exception of revenue from new construction, a levy cannot generate more revenue than it collected in the prior year. This protects taxpayers from having a government ‘revalue’ their property just to increase revenue. Because of this there is a reduction factor that is established by the state and applied to your Gross Tax Rate to produce the Effective Tax Rate. The Effective Tax Rate is then multiplied by your Taxable Value to produce your tax due prior to applicable deductions.

PROPERTY VALUES – The Appraised value is our opinion of what your property would sell for on the open market. The Taxable value is 35% of the Appraised Value and is what your tax amount due is based on prior to any credits being applied. Improvements is another word for Buildings. If you see a CAUV value this means you are currently in the CAUV (Current Agricultural Use Valuation) program and receiving a reduction on your taxes.

TAX VALUES – This section details your tax calculation for the full year and any applicable reductions such as the Non Business Credit, the Owner Occupancy Credit, or the Homestead credit. This area also includes the addition of any CAUV Recoupments or Special Assessments. If you would like a more detailed explanation of these credits, please visit their respective pages on our website. If you are enrolled in the Owner Occupancy Credit (2.5% Reduction), Homestead Reduction a value will appear in the appropriate box. If you see a value in the CAUV Recoupment line this mean that you have been removed from the CAUV (Current Agricultural Use Valuation) program.

TAX DISTRIBUTION – This shows you where your tax dollars are allocated after collection.

SPECIAL ASSESSMENTS – These tax assessments, known as special assessments, are localized additional charges that may include assessments for items such as mowing assessments, MWCD, sewer assessment, and special improvement districts. Not all properties are within a special assessment region, if you are it will be itemized on your tax bill.

TAX DELINQUENCY AMOUNTS – This section includes any delinquent real estate taxes and associated penalties and interest, delinquent special assessments and associated penalties and interest, and any omitted taxes. If you have questions about this please contact the Treasurer’s office.

RETURN MAILING STUB INFORMATION – This section of your tax bill provides you with the stub to bring in when you pay your taxes. It covers items such as where to mail your check, your parcel identification information, the due date, and the amount due for the full year and half year.