STEP 1 – DETERMINE YOUR MARKET VALUE

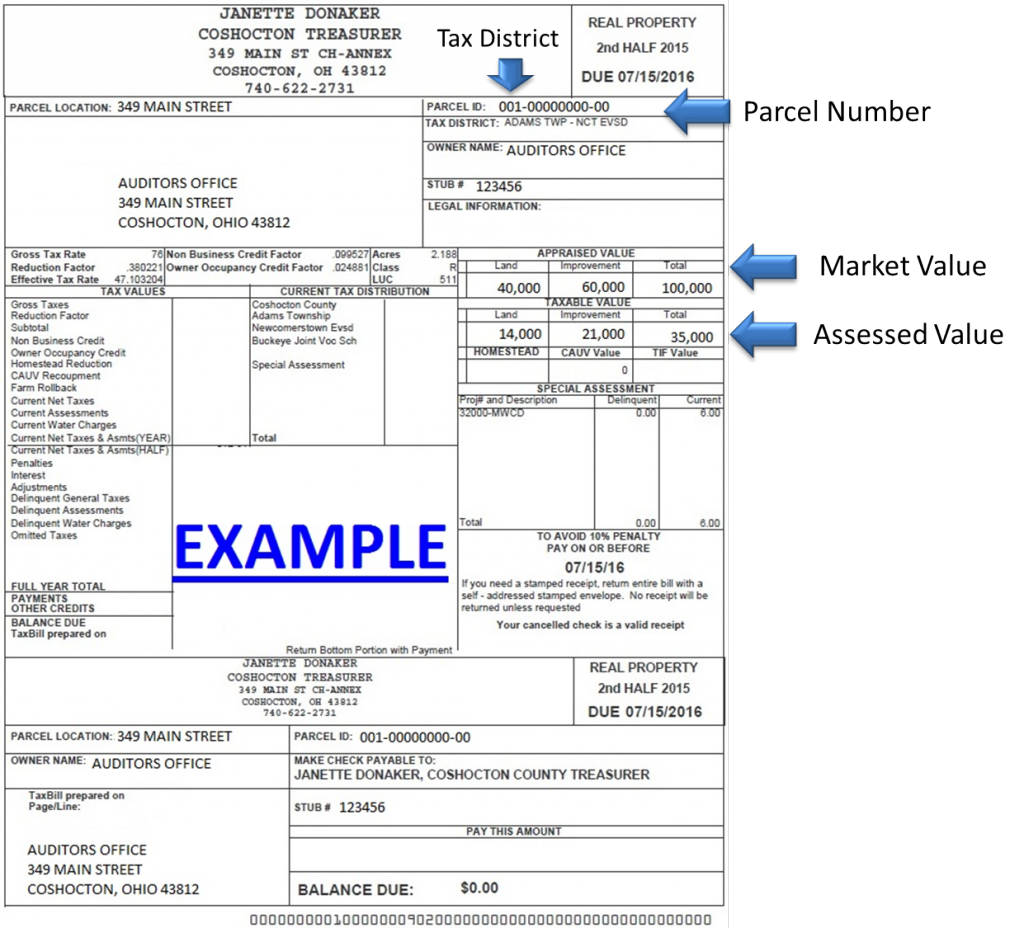

If you are building a home, the construction price (including labor) is the market value. If you are currently living in your home, you can look on the right side of your tax bill for the market value, visit www.coshcoauditor.org or contact the office to find out your market value. If you are looking at an existing home other than your own, market values can be located on the auditor’s real estate website at www.coshcoauditor.org

For this example the market value is $100,000

STEP 2 – CALCULATING THE ASSESSED VALUE

Take the total market value times 35% to get the assessed value.

For this example take $100,000 x .35 = $35,000

STEP 3 – FINDING YOUR TAXING DISTRICT

Your taxing district is determined by looking at your parcel number. Your parcel number can be found on your tax bill, visit www.coshcoauditor.org or contact the office to find out. Another way to find your taxing district – go to Tax Rates and open up the current tax rate sheet.

For this example parcel number 001-00000000-00 begins with 001 which is Adams Township – Newcomerstown School District

STEP 4 – DETERMINE THE EFFECTIVE RATE

Use the last two columns to determine which effective tax rate to use. The choices are Agricultural/Residential or Commercial.

For this example the effective tax rate is 47.103194 for an Agricultural/Residential property.

STEP 5 – MULTIPY

Multiply the number from step four by the assessed value.

For this example take 47.103194 x $35,000 = 1,648,611.79

STEP 6 – FIGURE YOUR TAX

Calculating yearly tax amount.

For this example take 1,648,611.79 / 1000 = $1,648.61

PLEASE NOTE:

- PLEASE NOTE:

- Please note the tax amount you have figured from the calculation above is simply an estimate!

- This formula does not take into account any special assessments which be levied on the property by your village, city or county. This formula also will not take into account any tax reductions due to Homestead Exemption, Owner Occupancy/2.5% Reduction or CAUV. To find out your current taxes for the property you already own, contact the Treasurer’s Office at 740-622-2731 or use the website at: www.coshcoauditor.org

- If you tear down a structure, or experience destruction to buildings on your property due to fire, flood, wind or other disasters, please fill out a Destruction Form and return to the office.

- If you build a new building, please fill out the New Construction Form mandatory by ORC 5713.17 that any construction or improvement costing $2,000.00 or more shall be reported to the County Auditor within sixty (60) days from its beginning to avoid a 50% penalty.

What is Market Value?

Ohio’s Constitution, laws and courts have determined that the “measure” to be used in determining the value of property for tax purposes is the “estimated fair market value.” Market value or “true value” is defined as the price your property would be expected to sell for in the open market place when your buyer and seller have full knowledge of all relevant facts about the property and the uses to which may put out, or how much a typically-motivated buyer would pay for a property when purchasing it from a typically-motivated seller.What is Assessed Value?

Assessed value is the value of property against which the tax rate is applied in order to compute the amount of taxes due. By Ohio law, assessed value is set at 35% of appraised value or market value.